What is a payroll API ?

A Payroll API is a set of protocols that allows third-party hr tools to connect and interact with payroll management software for data-exchange and other connectivity requirements.

Around 30% of organizations use 8-10 HR software for their everyday workforce management.

If you cut down the math, the average HR professional today uses one platform for HRIS, another for Payroll and perhaps, 6 other platforms for other core-HR tasks.

For a HR-Tech business to seamlessly integrate with an organizations’ payroll software, it is essential that they do at maximum efficiency with minimal or zero disruption for HR’s or their people-centric workflows.

This guide walks you through the following :

Top Payroll providers in the market

Key concepts to be familiar before for Payroll API Integration

Data Schemas in payroll API

Payroll API Integration - Different Methodologies & Best Practices

Payroll API - Benefits and Challenges

Top Payroll APIs At a Glance

This table provides a clear view of the market share held by each payroll provider in the HR/Payroll sector.

Payroll API - Key Concepts

In order to effectively integrate payroll APIs, it’s essential to understand the key concepts that underpin payroll systems.

This section will break down the core components and provide actionable guidance on how to handle payroll data.

Companies and Employees

Every payroll system revolves around companies and their employees. These two entities form the foundation of all payroll operations and API interactions.

- Companies: Represents the organization responsible for managing payroll and ensuring employees are paid correctly. Key data includes:

- Company name

- Tax ID or EIN (Employer Identification Number)

- Address and contact details

- Employees: Individuals who work for the company and receive compensation. You’ll typically work with data fields like:

- Employee ID

- Full name and contact information

- Job title and department

- Pay rate and payment method (direct deposit, check, etc.)

Pay Periods and Payroll Runs

Pay periods are the recurring time frames during which employee work is tracked for compensation. Payroll systems often work on weekly, bi-weekly, or monthly pay periods.

- Payroll runs represent the actual processing of payroll for each pay period. They include the calculation of gross pay, deductions, and net pay.

- Regular payroll runs: These occur at predefined intervals (e.g., every two weeks).

- Off-cycle payroll runs: These are one-time payments outside the regular schedule, often used for bonuses or corrections.

Jobs and Pay Rates

Each employee holds a job, which typically includes a pay rate—the amount they earn per hour or as a salary.

- Job: Defined by a title and the employee’s specific responsibilities. For instance, “Software Engineer” or “Customer Support Lead.”

- Pay Rate: The employee’s compensation. This could be:

- Hourly: The employee is paid per hour worked.

- Salary: A fixed amount paid per pay period, regardless of hours worked.

- Commissions/Bonuses: Additional payments on top of regular wages.

Actionable Step: When integrating payroll APIs, store job details and pay rates securely, ensuring that any changes to job roles or pay are accurately reflected in your payroll system.

Payroll API Data Schemas

Payroll API data schemas define how data is structured and exchanged between applications.

Employee Data Schema

The employee data schema typically includes the following fields:

- Employee ID: A unique identifier for each employee.

- First and last name: Employee’s full legal name.

- Social security number (SSN): Required for tax purposes.

- Contact details: Address, phone number, and email.

- Employment status: Whether the employee is full-time, part-time, or a contractor.

Example Schema:

Pay and Tax Information Schema

The payroll API needs to manage pay and tax information to accurately calculate compensation.

Key fields include:

- Gross pay: The employee’s total earnings before any deductions.

- Net pay: The amount the employee takes home after deductions.

- Tax withholdings: Federal, state, and local taxes withheld from gross pay.

- Benefit deductions: Deductions for health insurance, retirement plans, etc.

Example Schema:

Actionable Step: Ensure accurate tax and benefit calculations by mapping the correct fields to the payroll API’s schema. Mismanagement of tax fields can lead to non-compliance with labor laws.

Payroll API Integration - Step-by-Step Guide

To directly integrate with any payroll platform, the guidelines and documentation might different with each platform. But here’s a high-level overview of the entire process.

1. Prerequisites

Before starting the integration, ensure the following prerequisites are met:

- API Access: Obtain the necessary API keys, tokens, or credentials from the payroll provider (or your end-user i.e HR teams in this case).

- This may require registering your application with the provider’s developer portal.

- Development Environment: Ensure your development environment is set up with required libraries (e.g.,

axios,requests, orfetchfor HTTP requests).- Example Libraries:

- For JavaScript/Node.js:

axios,fetch - For Python:

requests - For Java:

HttpClient

- For JavaScript/Node.js:

- Example Libraries:

- Postman or cURL: Familiarity with API testing tools for validating API requests and responses during development.

2. API Authentication

Most payroll APIs require secure authentication to access their endpoints. The two most common authentication methods are:

A. OAuth 2.0:

- This method provides a more secure, token-based authentication, usually involving multiple steps: obtaining an access token via a client ID/secret and using it for authorization.

- Steps:

- Obtain client ID and secret from the API provider.

- Exchange these credentials for an access token.

- Use the access token in API requests.

B. API Keys:

- Simpler than OAuth, this involves passing an API key in the header of each request.

- Example Request with API Key:

GET /employees

Authorization: Bearer YOUR_API_KEYActionable Tip: Make sure to store API keys and tokens securely, and never hard-code them in your source files. Use environment variables or secure vaults to manage sensitive information.

3. Key API Endpoints

Understanding and correctly utilizing key API endpoints is critical for seamless payroll integration.

Here are common endpoint categories you will interact with:

A. Employee Management:

- Create a New Employee:

POST /employees- Example Request Body:

{

"firstName": "John",

"lastName": "Doe",

"email": "john.doe@example.com",

"salary": 60000,

"startDate": "2024-01-01"

}- Retrieve Employee Details:

GET /employees/{id}- Update Employee Information:

PUT /employees/{id}Use Case: Update employee records when salary, address, or employment status changes.

B. Payroll Processing:

- Initiate a Payroll Run:

POST /payroll- Example Request Body:

{

"employeeId": "1234",

"payPeriodStart": "2024-01-01",

"payPeriodEnd": "2024-01-15",

"grossPay": 3000

}- Retrieve Payroll Run Details:

GET /payroll/{id}

C. Reporting:

- Generate Payroll Reports:

GET /reports/payrollTip: Before sending requests, ensure you understand the required and optional parameters for each endpoint. Refer to the API documentation to avoid missing fields that could lead to errors or incomplete data handling.

4. Data Formats

Most payroll APIs use JSON for data exchange.

Ensure that the requests you send and responses you handle are correctly formatted. Proper handling of JSON will ensure that the data sent to and received from the payroll system is accurate.

Example Request Body (Create Employee):

{

"firstName": "John",

"lastName": "Doe",

"email": "john.doe@example.com",

"salary": 60000,

"startDate": "2024-01-01"

}

Response Format (Payroll Processing):

{

"payrollId": "001",

"status": "Processed",

"employee": {

"employeeId": "1234",

"name": "John Doe",

"netPay": 2800,

"taxDeductions": 200

}

}Tip: When handling JSON, validate both the structure and data types before sending a request or processing a response to avoid runtime errors and invalid data submissions.

5. Error Handling

Most APIs return HTTP status codes along with error messages to help developers identify and fix issues.

Example Error Response (401 Unauthorized):

{

"error": "Authentication failed",

"message": "Invalid API key or token"

}Actionable Step: Implement a retry mechanism for transient errors (e.g., 500 Internal Server Error) but ensure there are limits to prevent endless retries. Also, log errors with sufficient detail for debugging, but avoid logging sensitive information (like tokens or API keys).

6. Testing the Integration

Before deploying the integration into production, it's critical to test every API endpoint and workflow to ensure proper functionality. Use the following tools to test the API and validate the integration:

- Postman: Use this for manually testing API calls, inspecting responses, and simulating workflows before implementing the integration in code.

- cURL: A command-line tool to quickly test API endpoints and review the output.

Testing Steps

- Authentication: Ensure that API keys or OAuth tokens are working as expected.

- Endpoint Responses: Test all the endpoints your application will use to ensure data is returned correctly and in the expected format.

- Error Scenarios: Simulate common error scenarios (e.g., invalid employee data, incorrect API keys) to confirm that your application handles errors gracefully.

- Edge Cases: Test edge cases like processing payroll for an employee with missing data or running payroll for an empty pay period.

Example Postman Test:

- Test: Send a POST request to

/employeesto create a new employee and check the status code. - Expected Response: Status code

201 Created, with the employee details returned in the response body.

Actionable Step: Set up automated API tests for your core integration workflows using tools like Postman’s Collection Runner or automated testing frameworks (e.g., Jest, PyTest) to ensure ongoing functionality after updates.

Payroll API Integration using Bindbee

Overview - Bindbee is a unified API platform that lets you integrate with 50+ HRIS, ATS & Payroll pl in just platforms in just a few minutes. No-code, zero-maintenance integrations that offers round-the-clock data sync at one-tenth the cost of custom Integrations. Check out Bindbee today!

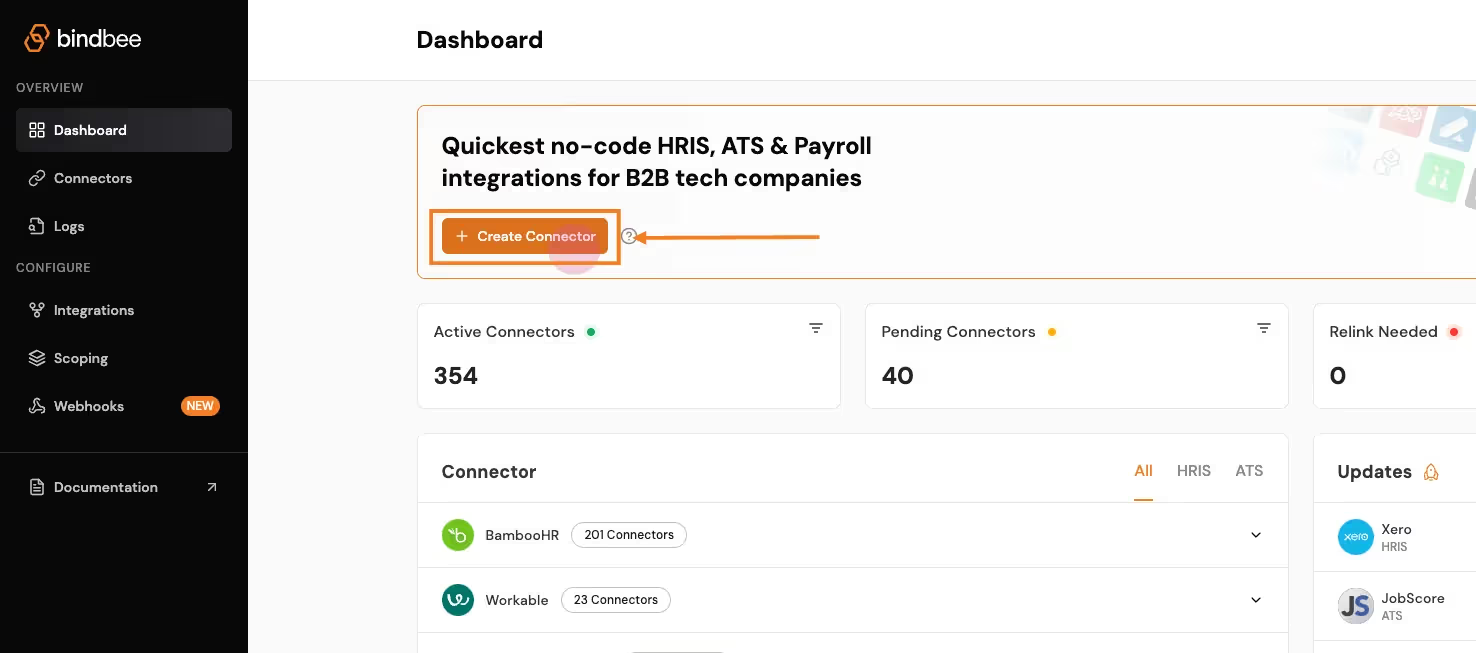

Setting up Payroll Integration with Bindbee

- Create a Connector:

- Click on Create Connector from the dashboard.

- Select Payroll as the type of integration. Enter customer details and give your connector a unique ID (e.g., ADP_Integration).

- Generate a Magic Link:

- After setting up the connector, click Create Link to generate a magic link. This will allow the customer to authenticate the connection with the Payroll API.

- Open the link and enter the necessary credentials (e.g., ADP key, subdomain). This step establishes the connection between the platform and Bindbee.

- Sync the Connector:

- Once the connection is made, the connector will begin syncing data from the payroll platform. This may take a few minutes depending on the size of the data. You can track the sync status in the connector section.

- Access the Synced Data:

- After syncing, go to the Employee section in the Bindbee dashboard and select Get Employees to retrieve employee data from the payroll platform.

Check out the entire documentation here - Bindbee’s API documentation.

Top Payroll API Use Cases

Payroll APIs offer several real-world applications that simplify payroll processes and improve efficiency.

Here are some common use cases:

Employee Onboarding

During the onboarding process, payroll APIs automatically collect employee data and set up payroll details such as bank account information, tax filing status, and benefits enrollment.

- Example: When a new hire joins, the API retrieves data from the HR system and pushes it to the payroll system to create the employee's payroll profile.

Employee Reimbursements

Payroll APIs can automate the process of reimbursing employees for expenses like travel or meals.

- Example: When an employee submits a travel reimbursement, the API adds it to the next payroll run for payout alongside regular wages.

Benefit Administration

Payroll APIs handle the deduction of employee benefit costs, such as health insurance or retirement contributions.

- Example: During payroll runs, the API calculates benefit deductions based on the employee’s chosen plans and deducts the appropriate amount from their pay.

Benefits of Payroll API Integration

Accurate Data

Payroll APIs ensure that data flows between systems in real time, reducing the chances of errors caused by manual data entry.

- Example: When an employee updates their bank details in the HR system, the API automatically syncs this information with the payroll system, preventing failed payments.

Automation

By automating payroll tasks such as tax calculations, benefit deductions, and payroll runs, APIs eliminate the need for manual processing.

- Example: During each payroll run, the API automatically applies tax rates and benefit deductions based on the latest employee information.

Improved Compliance

Payroll APIs can help businesses remain compliant with ever-changing tax laws and labor regulations.

- Example: The API ensures that the correct federal and state taxes are applied based on the employee’s location, reducing the risk of non-compliance penalties.

Reduced Risk

By centralizing payroll data, APIs reduce the risk of data silos, ensuring that all HR and payroll systems operate with consistent, up-to-date information.

- Example: When payroll and HR systems are integrated via API, they share the same source of truth, reducing discrepancies in employee data.

Challenges in Payroll API Integration

While payroll API integration offers numerous benefits, it also comes with challenges.

Data Fragmentation

The payroll software market is fragmented, with different APIs using varying data formats, making integration complex.

- Example: Some payroll providers may require unique data structures, making it difficult to standardize integration across multiple systems.

Security Concerns

Payroll data is highly sensitive, containing personal employee information and financial data. Ensuring secure transmission and storage is critical.

- Example: Without proper encryption, payroll data transmitted over APIs could be intercepted, leading to potential data breaches.

Compliance with Labor Laws

Different countries and regions have varying tax laws and labor regulations, making it essential for payroll integrations to handle these differences.

- Example: An API integration that works for U.S. payroll may not automatically comply with EU tax laws, requiring localization.

Simplify Payroll Integrations With Bindbee

Regardless of your role as an HR leader or a tech vendor, at the end of the day, everything done in this space called ‘Human Resources’ is to benefit the most valuable asset for you and your customers:

People.

So why not go down the route that is faster, easier, and affordable for all?

With Bindbee, anything and everything Integrations is simplified for all parties involved.

Our Unified API is engineered with three-core functionalities - targeted data access, agility, and transparency in end-to-end operations.

No more added bandwidth from your engineering talent for In-house maintenance, no more complexities, no more back-and-forth between your customers’ HR and IT teams.

Just fast, easier, and robust Integrations that are as efficient as efficiency can get.

Don’t take our word, talk to one of our experts today to find out why we’re the perfect fit for your connectivity requirements.

Skip the wait, Book a demo today.

.png)